This essay is the third in a series that explores the tensions between the business of now and the business of the future. In the first two essays we riffed on the first two Back to the Future films, building a case for Future Generations Boards in the corporations of today.

In this piece, we’re going to complete the trilogy, and end our stretched analogy of using the Back to the Future films as a framing device. So, let’s head back to the wild west of Back to the Future 3.

I know what you’re thinking already, it’s the worst film in the series. Agreed. The plot is mostly the same as the other two. Marty gets involved with his parents, he must battle Buford (Biff), and Marty and Doc have to get the DeLorean time machine working again, this time with the help of a steam train. The ending, also, feels disappointing, with Doc wishing Marty and Jennifer a wonderful future and to remember that their future has not yet been written. This sentiment, from an older person to a younger one, is positive and wonderful. Yet, it’s also the type of line that is a little confined to fiction and the wish fulfillment of Hollywood script writers and, as we’ve been exploring in these articles, the relationship between generations is rarely this straightforward, or generous.

No matter what Doc says, the immediate future is written, and it doesn’t bode well for the next generation of leaders (or any of us). At the current rate of emissions from publicly listed companies it is predicted that by the end of this century, the planet will warm by 2.7C. Further, we are likely to pass the point of no return and achieve 1.5C of warming by the end of 2026 - a mere three and a half years away. If only we could get Marty to jump into his DeLorean and get company leaders of the past to make different decisions. If only, but we can’t.

In the previous articles we outlined the correlation between the age of a CEO, and whether the company they lead has an emissions reduction target. It shouldn’t come as a surprise that as CEOs get older, the companies they lead are less likely to have an emissions reduction target. But now let’s consider not just a company’s emissions, but also its Environmental, Social and Governance (ESG) scores. And again, with this metric, we find that age matters - the increasing age of a CEO negatively correlates to ESG scores.

At this point, it’s worth taking a minor detour to explain what Environmental, Social and Governance (ESG) is. ESG is an investor-led initiative that is a response to societal demands for more sustainable outcomes. ESG score providers offer overall ESG scores for companies and then sub-scores for the E, S and G components. The purpose of an ESG score is that it helps us understand how a company is performing in non-financial measures. The general perception in the investor market is that the higher the ESG score, the more sustainable the company. Albeit ESG scores do not conflate directly to sustainable outcomes.

Our analysis of 2000 companies and their ESG scores (and the sub-scores for the E, the S and the G) is telling, although none of this should come as a surprise.

- The age of a CEO negatively correlates to the overall ESG score of a company and particularly to the individual E and S scores. Hence, the older a CEO the lower these scores.

- If the CEO and the chairperson are the same, there is a negative correlation to the overall ESG score as well as the individual E, S and G scores. Thus, power is corrosive to ESG scores.

- A higher percentage of non-executive directors positively correlates to the overall ESG scores and individual S and G scores. Thus, more non-executive directors will tend to lead to higher ESG scores.

- Company age positively correlates to overall ESG and individual E, S and G scores. Thus, the longer a company has existed the more likely it is to have higher ESG scores.

- Company size, as measured by asset value, positively correlates to overall ESG and individual E, S and G scores.

While only a snapshot, our analysis reinforces the idea that the age of a CEO matters to whether a company is pursuing ESG initiatives. This disconnect, exacerbated by age, is already seeing younger people shunning employment at companies with low scores.

Yet the disconnect remains. It’s a disconnect between those making the decisions and the desires of those who will be leaders in thirty years or so, a generational timeframe. It reinforces our belief that the way to address this is for companies to consider the needs of future generations. This could be done by the establishment of boards, committees and representatives that would exist within their corporate governance structures. Thankfully, this future is out there, it’s just not evenly spread and perhaps not yet fully developed. For example, the country of Wales has a Future Generations Commissioner and The Body Shop and Good Energy have young persons’ boards.

So where to from here? We know that Doc’s proclamation to Marty and Jennifer at the end of Back to the Future 3, that the future is not yet written, is only partially true. In the short term, older generations have stuffed things up good and proper. But that doesn’t mean we can’t, as Doc suggests, still make the future a good one. We can, but to do so we need to counter the effect of older CEOs with input from the future generation by way of a future generation board.

It will be a battle, for sure. But in the end, let’s return to Marty McFly. His predicament is not escaping the time he finds himself in, rather its navigating and battling the previous generation and their predicaments. The fight is circular, often confusing, but the ramifications of not fighting are clear, you cease to exist. Back to the Future 3 is often thought of as the weakest in the trilogy, but perhaps that’s unfair. The lesson here, taught relentlessly across 3 films, is that the future always needs to be fought for, time and time again, and we think it’s time for those in charge now to join the fight by connecting with those who will be in charge.

For a deeper dive into these ideas, check out the following links

- The first two essays in the trilogy can be found via the following links - 1 - No Time Travel Needed, 2 – We Have the Almanac

- For information on predictions of climate warming by the end of the century and the current targets of companies see the following website which outlines we are due to increase warming by 2.7C by the end of the century as of May 2023 - MSCI Climate Tracker May 2023 – Available at this website - https://www.msci.com/research-and-insights/net-zero-tracker

- This paper offers discussion on the relationship between ESG and sustainability -https://www.lancaster.ac.uk/pentland/news-and-events/blog/esg-and-sustainability-different-but-related-ideas

- This link provides details on the data.

- The following article highlights employment trends and ESG scores and how younger people are do not prefer companies with low ESG scores - https://www-edie-net.cdn.ampproject.org/c/s/www.edie.net/climate-quitters-one-fifth-of-uk-workers-have-turned-down-jobs-based-on-poor-esg-commitments/?amp=true

Professor Nick Barter

Nick's purpose is to help business become Future Normal (www.futurenormal.net) - enabling them to act meaningfully in our surroundings and purposefully to benefit society. A Future Normal business is one where the CEO and their teams are enabled to meet the challenges of the coming decades and that which is top of mind; optimizing enterprise value in the context of net-zero,DEI and sustainability. To achieve this, he researches with and advises business domestically and internationally and teaches into Griffith University's world-leading MBA.

Prior to academia, he worked for Ernst and Young and Virgin Media in a variety of roles from strategy consultant through to Head of Business, Head of Strategy and Head of Marketing.

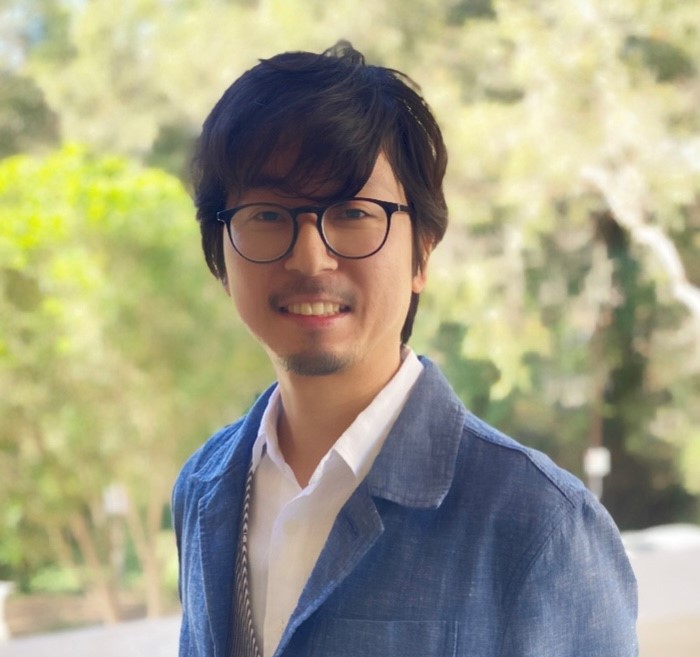

Dr Akihiro Omura

Dr Akihiro Omura is a Lecturer in Finance. His research interest lay in Responsible Investing, Climate Finance, Commodity Economics and Finance, Asset Pricing and Financial Risk Management.

He has also worked as an equity analyst at major financial institutions in Japan for six years.

The Worker Learner

Featuring stories and insights for our working lives, the Worker Learner podcast is hosted by Griffith University academics and features extraordinary guests doing extraordinary things. The conversations not only address skills required in the workplace of today and tomorrow, they challenge us to think about the kind of world we want to work and live in.

Proudly produced by the Professional Learning Hub.