Corporate purpose has come to the fore over the last decade with an indicative indicator of this prominence being that it is now searched on Google nearly twice as often as it was a decade ago[i].

Given this and annual surveys highlighting the increasing importance of purpose to CEOs[ii], it is evident that within the current business context corporate purpose matters.

A corporation’s purpose is considered its why, its guiding philosophy[iii]. It is a language device that aims to shape the thoughts and acts of an organization’s stakeholders. An efficacious purpose statement is one that is pro-social, embodying an enduring reason for the organization to exist, a framing device for how decisions are made, and a guide to the identification of profitable opportunities[iv]. Given this, purpose statements are also argued as being a tool that brings forward a wider perspective and may enable a shift from narrow shareholder capitalism to stakeholder capitalism.

Stepping back, the purpose of corporations has been debated over decades. For example, placing the corporation in society and providing it with some form of social obligation beyond meeting its own returns has been argued as a phenomenon that arose with organizations such as Cadbury and Sunlight Soap and their housing for workers in the late 1800s[v]. Coming forward in time, during the last century the purpose of a corporation was debated within the Harvard Law Review, with one advocate arguing for shareholder primacy, while another advocated for a wider purpose that included secure employment, quality products and contributing to societal wellbeing. In 1954 the argument had been settled in favour of the broader conception[vi]. Yet, just under twenty years later, Milton Friedman tipped the scales firmly in favour of shareholder primacy with his 1970 article in the New York Times. An article that argued the only social responsibility of business is to increase its profits[vii].

Until recently shareholder primacy has been uncontested, however over the last decade there have been more calls for a stakeholder perspective to guide corporations to success. In 2018, Larry Fink the chairperson and CEO of BlackRock, one of the world’s largest asset managers, outlined in his letter to shareholders that “without a sense of purpose, no company, either public or private, can achieve its full potential”[viii]. Alongside the statements of Mr. Fink, the Business Roundtable of America adopted a new statement that the purpose of a corporation is to deliver value for all stakeholders[ix]. While the Davos Manifesto 2020 argued that the purpose of a company was to “engage all its stakeholders in shared and sustained value creation”[x]. In 2021, Mr. Fink doubled down and argued that purposeful companies outperform their peers and have better environment, social and governance (ESG) profiles[xi]. An argument that implies companies with a purpose are potentially more sustainable and taking a wider stakeholder perspective.

Turning from context to this initial piece of research on the ASX100 (the Australian Stock Exchange 100)[xii]. Between March and June of 2023, data on the purpose, vision, mission, and values of the ASX100 was gathered[xiii]. Of this list of companies, 70% had a purpose statement and 30% did not. Those with a purpose statement tended to have language in those statements that emphasised building a better world, future prosperity, stakeholder and shareholder value, and more sustainable outcomes.

After gathering the purpose statements of the companies, we analysed the companies with purpose statements relative to the companies without purpose statements against a range of company performance metrics. These metrics were gathered from the Refinitiv database and included ESG (Environmental, Social and Governance) scores, the debt-to-equity ratio and the return on assets and return on equity percentages. From here we conducted some statistical analysis and found the following results[xiv].

- Within the ASX100, companies with a purpose statement have a statistically higher overall ESG score relative to companies that do not have a purpose statement. Further companies with a purpose statement allow have a statistically higher individual E, S and or G score.

Within each of the Environmental, Social and Governance pillars are component scores. For these component scores, companies that have a purpose statement score statistically higher than companies that do not have a purpose statement.

- For example, within the Environmental pillar, companies with a purpose statement score statistically higher on resource use, emissions, and innovation relative to companies that do not have a purpose statement. Thus, companies with a purpose statement are being more efficient in their use of materials, reducing their emissions and being more innovative in their reduction of the environmental costs for customers relative to companies without a purpose statement.

- Then within the Social pillar, companies with a purpose statement are performing more strongly on workforce, human rights, and community scores relative to companies that do not have a purpose statement.

- Last within the Governance pillar, companies with a purpose statement are performing more strongly than companies without a purpose statement on management scores and the integration of the SDGs (Sustainable Development Goals) into business strategy.

Moving from ESG scores to consider financial performance, the analysis found;

- Companies with a purpose statement are statistically, seeing higher return on equity percentages relative to companies without a purpose statement. However, companies with a purpose statement are seeing lower return on asset percentages and higher debt to equity ratios relative to companies without a purpose statement.

Taken together, these results reveal something interesting, a signal. A signal that companies with purpose statements are performing better in terms of ESG metrics and in their return on equity percentage relative to companies that do not have a purpose statement. Prima facie this indicates that purpose is contributing to organizations shifting to a wider stakeholder perspective which in turn is producing returns for shareholders. Further, this signal might point to a shift towards purpose enabling more sustainable outcomes. However, all this said a result from a small sample, a signal is not a trend. Hence, more work needs to be done to prove whether purpose, a language device, is having an effect or whether something else is happening. Nevertheless, whether the shift is happening or not, it might be that the purpose statements are challenging the myopia and maxim of shareholder capitalism, and the wider perspective facilitated by a purpose statement enables the foolishness of this maxim to be seen with greater clarity.

The analysis of the ASX100 reveals a signal that points to companies with a purpose statement having improved equity returns and improved ESG scores relative to companies that do not have a purpose statement. Such a result chimes with other academic arguments[xv] and hints towards the validity of definitions of purpose that argue it is key to enabling organizations to solve societal problems profitably[xvi]. However, a signal does not make a trend and thus from here, we intend to review the data from other stock exchanges, for example the FTSE100 and the S&P100. If you want to join this conversation, please reach out.

[i] Google Trends worldwide data on the search term ‘corporate purpose’ for July 2013 to July 2023

[ii] For example see the Brandpie CEO report series - https://www.brandpie.com/thinking/ceo-purpose-report

[iii] Collins, J.C. and Porras, J.I., 2008. CMR classics: organizational vision and visionary organizations. California management review, 50(2), pp.117-137.

[iv] Mayer, C., 2021. The future of the corporation and the economics of purpose. Journal of Management Studies, 58(3), pp.887-901.

[v] Hirsch, P.B., 2016. Profiting on purpose: Creating a master narrative. Journal of Business Strategy.

[vi] Harrison, J.S., Phillips, R.A. and Freeman, R.E., 2020. On the 2019 business roundtable “statement on the purpose of a corporation”. Journal of Management, 46(7), pp.1223-1237 citing Stout, L., 2012. The shareholder value myth: How putting shareholders first harms investors, corporations, and the public. Berrett-Koehler Publishers.

[vii] Friedman, M., 1970. A Friedman doctrine: The social responsibility of business is to increase its profits. The New York Times Magazine, 13(1970), pp.32-33.

[viii] Fink, L.D., 2018. An Annual Letter to Shareholders. BlackRock Annual Report. - Available at; https://www.blackrock.com/corporate/investor-relations/2018-larry-fink-ceo-letter, Accessed 8th August 2022.

[ix] Business Roundtable, 2019, Statement on the Purpose of an Organization, https://www.businessroundtable.org/purposeanniversary, Accessed 11thAugust 2022.

[x] Schwab, K., 2019, December. Davos Manifesto 2020: The universal purpose of a company in the fourth industrial revolution. In World economic forum (Vol. 2).

[xi] Fink, L.D., 2021. An Annual Letter to Shareholders. BlackRock Annual Report. - Available at; https://www.blackrock.com/us/individual/2021-larry-fink-ceo-letter, Accessed 8th August 2022.

[xii] Australian Stock Exchange (ASX) companies are companies listed on the Australian stock exchange. The ASX100 are the largest companies by market capitalization. The list of companies in the ASX100 changes on the 3rd Friday of every three months (March, June, September and December). The list of ASX100 companies was gathered from this website - https://www.marketindex.com.au/asx-listed-companies

[xiii] The list of ASX100 companies was initially gathered in March of 2023, then due to the elapsed time of analysis it was re-gathered in June 2023. This meant that ultimately a total of 102 companies were analyzed as some new companies joined the ASX100 list while others fell off the list due to acquisitions and market capitalization fluctuations during that time.

[xv] For example see Gartenberg, C., 2022. Purpose-driven companies and sustainability. In Handbook on the Business of Sustainability (pp. 24-42). Edward Elgar Publishing or Perez L, Hunt V, Samandari H, Nuttal R, Biniek K, 2022 Does ESG really matter – and why?, Available at https://www.mckinsey.com/business-functions/sustainability/our-insights/does-esg-really-matter-and-why?cid=other-eml-dre-mip-mck&hlkid=54fb1aa4bdff425a81fe750ea27f7ce3&hctky=13309553&hdpid=c7f2c6a1-42c0-4634-9fea-a51c9e4372b0, Accessed 12th August 2022. Gartenberg argues purpose can enable the sustainable development goals to be incorporated into a firm rather than them be considered an externality. While Perez et al argued that ESG measures anchor purpose and provide it with credibility and forms of measurement.

[xvi] Mayer, C., 2021. The future of the corporation and the economics of purpose. Journal of Management Studies, 58(3), pp.887-901.

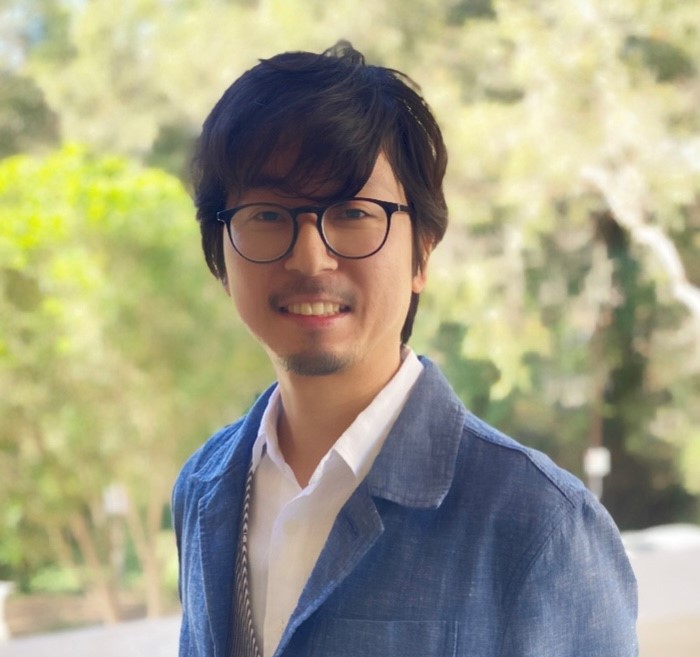

Professor Nick Barter

Nick's purpose is to help business become Future Normal (www.futurenormal.net) - enabling them to act meaningfully in our surroundings and purposefully to benefit society. A Future Normal business is one where the CEO and their teams are enabled to meet the challenges of the coming decades and that which is top of mind; optimizing enterprise value in the context of net-zero,DEI and sustainability. To achieve this, he researches with and advises business domestically and internationally and teaches into Griffith University's world-leading MBA.

Prior to academia, he worked for Ernst and Young and Virgin Media in a variety of roles from strategy consultant through to Head of Business, Head of Strategy and Head of Marketing.

Dr Akihiro Omura

Dr Akihiro Omura is a Lecturer in Finance. His research interest lay in Responsible Investing, Climate Finance, Commodity Economics and Finance, Asset Pricing and Financial Risk Management.

He has also worked as an equity analyst at major financial institutions in Japan for six years.

Joanne Kerr

Jo has over 20 years’ experience in marketing, brand and communications in both client and agency environments. Specializing in large, global, B2B organizations she understands the complexity involved in transformation and change at scale and is passionate about the role purpose can play in creating clarity and momentum in these complex environments. As Strategy Partner, Jo works across brand, culture and campaign projects to develop ideas that build long-lasting behavioral change in people, and ultimately stronger, more sustainable businesses.

The Worker Learner

Featuring stories and insights for our working lives, the Worker Learner podcast is hosted by Griffith University academics and features extraordinary guests doing extraordinary things. The conversations not only address skills required in the workplace of today and tomorrow, they challenge us to think about the kind of world we want to work and live in.

Proudly produced by the Professional Learning Hub.